Electronics Manufacturing & Assembly Insurance

Keeping production lines operating

The risks faced by businesses are constantly evolving, particularly when new hardware, equipment and technologies are involved. Travelers is known as a reliable and trustworthy partner for companies who assemble and manufacture electronics.

Our team’s depth of experience in the industry helps insureds feel prepared to manage their operational threats. Whether they are assembling electronic components or manufacturing innovative bespoke hardware, they can have confidence they are protected if something goes wrong.

Our appetite

We cover

These fall within our appetite, and we’re happy to discuss details.

- Lab equipment

- Broadcasting equipment

- Communication equipment

- Audio and video equipment

- Lighting

- Computer hardware/peripheral equipment

- Photographic equipment

- Scientific instruments and related software

- Electrical office equipment such as printers and photocopiers

- Wearable technology

We’ll consider

We may need more information to confirm a fit.

- Computer chips/printed circuit board (PCB) stuffing (depends what they control)

- Physical security systems such as CCTV or biometric

- Switchgear

- Antennae or amplifiers

- Control systems

- Industrial electronics (e.g., sensors, process or quality control equipment)

- Electrical or electronic components

- Building management systems

- Electronics for the defence industry

- Smart home solutions

- Robotics & robotics systems

We do not cover

Sorry, we’re currently unable to insure the following.

- Aviation, rail, marine or automotive products, if safety critical

- Whole fire alarm systems

- Safety critical oil or gas products

- Batteries

- Mobile phones

- Nanotechnology

- PCB bareboard manufacturing or semi-conductor manufacturers

- Waste material dealers

- E-scooters or electronic transport

Electronics manufacturing & assembly covers & highlights

-

General

- Warranty and condition precedent free

- One package policy with no gaps

- Access to HCL for pre-breach services

- Access to post-breach services

- Access to Travelers eRiskHub for claims examples and cyber training assessments

- Access to cyber risk control consultancy

-

Professional indemnity (PI) & intellectual property rights (IPR)

- Civil liability wording

- Written and verbal contracts covered

- Option of any one claim or aggregate claim basis

- Option of a costs in addition or costs inclusive basis

- Excess not applicable to defence costs

- Auto U.S. jurisdiction – PI & IPR

- Third-party fines covered to PI limit

- Sub-contractors explicitly covered

- Auto acquisitions

- Auto additional insured cover

- Liquidated damages included in the definition of ‘loss’

- Awards of ombudsmen

- IPR includes patent and trade secret (excluding U.S.)

-

Cyber business costs (first-party cyber)

- Clear trigger language arranged on a losses discovered basis

- Extended discovery period of 90 days after cancellation

-

Breach response

- Privacy breach notification

- Computer and legal experts

- Betterment

- Public relations

- Data restoration

- Cyber extortion

-

Cyber crime

- Computer fraud

- Funds transfer fraud

- Telecommunications fraud

- Social engineering fraud

-

Business loss

- Business interruption, including IT providers and outsource providers

- Reputational harm

- System failure

- Damage to computer systems

- Incompatibility of computer systems

-

Cyber liability (third-party cyber)

- Privacy breach cover

- Transmission of computer virus

- Failure to comply with data protection law

- Invasion of rights of privacy or publicity

- Defamation, libel and slander

- Liquidated damages included

- Auto acquisitions cover

- Computer systems, including personal devices when used for business

-

Casualty

- Automatic pre-claim rehabilitation cover provided under the employers’ liability (EL) section

- Public relations costs cover under the EL and PL/PR sections

- Automatic North American jurisdiction cover provided in respect of public and products liability

- No efficacy exclusion under PL/PR section

- Auto additional insured cover under the PL/PR section

- Ability to include products recall withdrawal expenses

- Vendor liability

-

Property

- Property damage

- All risks cover as standard

- Specialist business interruption research and development (R&D) cover including payment pledges

- Options for flexible limits of loss

- Deferred payment (credit)

- Installation extensions

-

Goods in transit

-

Money and personal accident (assault)

-

Terrorism

-

Computer and machinery breakdown

-

Employers’ liability

-

Public and products liability

-

Product recall (costs only)

-

Legal expenses

-

Criminal protection response

General questions

These questions will give you a sense of the information needed to write a policy.

- How does the insured manage their contracts?

- How does the business cap their liability, and do they exclude consequential losses in their standard terms and conditions?

- What products are being supplied?

- What industries are the products supplied to?

- Could details of any products be considered safety critical?

- Are the products made to the insured’s own design or to a customer’s specification?

- What quality controls are in place?

- What standards are the products manufactured to?

- Does the client have a business continuity plan?

- Please provide details of the insured’s largest three contracts.

Let's get specific

These are the kinds of detailed questions we will ask to better understand day-to-day operations.

This trade includes manufacturers of integrated circuits or “chips” that can be integrated into products used in a variety of industries. This trade incorporates the “stuffing” of PCBs. Note: bareboard manufacturing is outside of our appetite.

Please explain to us:

- What products do the chips go into?

- In which industries are those products used?

- Do the chips go into any safety-critical applications?

- Are they made to the insured’s own design or to a customer’s specification?

- What quality controls are in place?

- Where are the bareboards manufactured? Does the supplier hold their own products liability insurance and are all rights of recourse still intact?

- Does the insured have a product recall plan?

- Do you have details regarding traceability of the products?

Please note that any chips going into safety-critical applications are likely to be outside of appetite.

This trade includes manufacturing, distribution, installation or integration of physical security systems or products, such as access entry systems, CCTVs and/or biometric applications.

Please explain to us:

- What products are being supplied?

- In which industries are the products being used?

- Are the products used in aviation or any safety-critical applications?

- Are the products made/installed to the insured’s own design or to a customer’s specification?

- What quality controls are in place?

- What quality standards are the products manufactured to?

- If the insured does not manufacture, who are they sourcing the products from? Do they hold their own products liability insurance and are all rights of recourse still intact?

- Does the insured have a product recall plan?

- Are details available regarding traceability of the products?

This trade is used to control, protect or isolate electrical circuits and equipment.

Please explain to us:

- What products are being supplied?

- In which industries are the products being used?

- Are the products used in aviation, nuclear or any safety-critical applications?

- Are the products made/supplied to the insured’s own design or to a customer’s specification?

- What quality controls are in place?

- What quality standards are the products manufactured to?

- If the insured does not manufacture, who are they sourcing the products from? Do they hold their own products liability insurance and are all rights of recourse still intact?

- Does the insured have a product recall plan?

- Are details available regarding traceability of the products?

- Describe to what extent the insured are involved in the installation of the switchgear?

Please note that any switchgear going into safety-critical applications is likely to be outside of appetite.

This trade encompasses companies that service, maintain or supply electronic communications components on radio, TV, data or voice wireless towers.

Please explain to us:

- What products are being supplied?

- Are the products made/supplied to the insured’s own design or to a customer’s specification?

- What quality controls are in place?

- What quality standards are the products manufactured to?

- If the insured does not manufacture, who are they sourcing the products from? Do they hold their own products liability insurance and are all rights of recourse still intact?

- Does the insured have a product recall plan?

- Are details available regarding traceability of the products?

- Is there any height work and, if so, how much?

- What training or experience does the insured have in undertaking height work?

This trade includes manufacturers of components, computers, instruments, software, services or monitoring products that are designed to control, regulate and automate other devices.

Please explain to us:

- What products are being supplied?

- In which industries are the products being used?

- Are the products used in aviation, nuclear, environmental, public utilities or any safety-critical applications?

- Are the products made/supplied to the insured’s own design or to a customer’s specification?

- What quality controls are in place?

- What quality standards are the products manufactured to?

- If the insured does not manufacture, who are they sourcing the products from? Does the supplier hold their own products liability insurance and are all rights of recourse still intact?

- Does the insured have a product recall plan?

- Are details available regarding traceability of the products?

- Describe to what extent the insured are involved in the installation of the industrial control system?

Please note that we are unlikely to be able to provide terms for control systems involved in safety-critical applications.

This trade covers any industrial or general electronics not covered in any other area.

Please explain to us:

- What products are being supplied?

- In which industries are the products being used?

- Are the products used in aviation, nuclear, environmental, public utilities or any safety-critical applications?

- Are the products made/supplied to the insured’s own design or to a customer’s specification?

- What quality controls are in place?

- What quality standards are the products manufactured to?

- If the insured does not manufacture, who are they sourcing the products from? Do they hold their own products liability insurance and are all rights of recourse still intact?

- Does the insured have a product recall plan?

- Are details available regarding traceability of the products?

Please note that we are unlikely to be able to provide terms for systems involved in safety-critical applications.

Related products

Technology

As the technology sector changes, insurance protection needs to evolve with it. Travelers can help anticipate potential risks so clients have more freedom to innovate.

IT & communications

Our in-market expertise covers the globe, with strategic alliances across more than 150 countries. Underwriters specialising in technology can deliver bespoke solutions for the sector and company scale.

MedTech & life sciences

Travelers has extensive expertise in insuring medical technology businesses. We work with companies of all sizes and specialities, offering industry-specific coverages and services that span the lifecycle of product development.

Cyber

Every company faces cyber threats and risks. Cyber cover helps businesses deal with the increasing complexity of digital crime.

Let’s start the right conversation

For business

Find a broker

If you’re looking for covers and have a broker, ask about Travelers products.

If you need a broker, start with the right broker directory.

Need to call us directly? Contact us.

For brokers

Tell us about your client

You’re likely busy. Let’s save some time.

We can help faster if you can give us information about your client first. Then we’ll call you back with the knowledge we need to make a decision.

Download a proposal form.

Questions? Call us.

Cyber insurance

Be cyber confident. Pre. Post. Always.

Cyber risks are a top concern for most businesses. Travelers’ covers are designed to provide reassurance and resilience in a threat-filled landscape.

Insights & industry knowledge

Articles to help your ambition succeed

Technology Resources

Five Keys to Choosing Global Cover for Tech Companies

For your tech clients to operate in a global business environment, they must be able to conduct business across borders through different markets, supply chain partners and distribution channels.

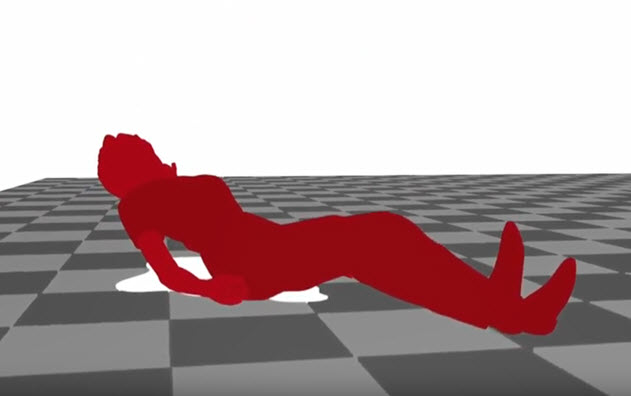

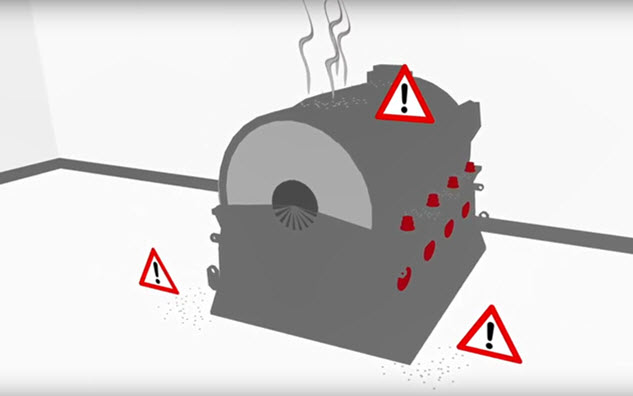

Workplace Safety Resources

Preventing Electrical Fires

These risk control guidelines can help businesses prevent problems with electrical systems and equipment.

Workplace Safety Resources

How to Prevent Slips, Trips and Falls

Following these health and safety practices can help prevent workplace injuries.