Professional Indemnity (PI) Combined Insurance for Small Businesses

Combined with you in mind

Almost every business begins as a small one which, with hard work, can grow. But starting a business – and maintaining one as it competes and expands – is laden with risks. Travelers has decades of experience managing these risks. We know that while small and medium enterprises (SMEs) have less time to manage risk, they still require a breadth of key business protections. That’s why we’ve developed a convenient, packaged solution just for them.

Travelers SME professional indemnity combined is comprehensive, bundling together covers such as professional indemnity, property, public and product liability, and cyber fundamentals, with the option to add legal expenses. Available to eTrade as a single policy, SME PI combined is the easiest, most efficient way to give smaller businesses the peace of mind they need to succeed.

Our appetite

![]()

We cover

These fall within our appetite, and we’re happy to discuss details.

Business consulting

- Business advisory service

- Business consultancy

- Management consultancy

- Management training

- Marketing

- Sales promotion consultancy

- Secretarial services

Creative industries and media

- Acoustic consultant

- Advertising

- Brand consultancy & design

- Copywriting

- Desktop publishing services

- Editorial consultancy

- Feng shui consultant

- Graphic design & website designers

- Illustrator

- Interpreter

- Market research

- Media consultancy

- Promotional consultancy

- Proofreading

- Public relations consultancy

- Publicity consultancy

- Screenwriting & scriptwriting

- Translation

Technology

- Computer consultancy

- Computer engineering

- Computer graphics

- Computer programming

- Computer services

- Computer training schools & services

- Computers – software

- Computers – software manufacturing

- Electronics consultancy

- IT consultancy

- Software consultancy

- Software engineering

Education and career services

- Career consultancy

- Careers advisory service

- Education advisory service

- Education – private

- Employment agency

- Employment consultant

- Home tutors

- Language tutor

- Recruitment consultancy

- Training advisory service

- Training consultancy

- Teaching

- Teaching – music

- Tuition

Other services

- Estate agents

- Information bureau

- Inventory consultancy

- Licensing consultancy

- Life coaching, training & management

- Lifestyle consultant

![]()

We’ll consider

We may need more information to confirm a fit.

Business consulting

- Administration

- Arbitration

- Business training

- Clerical services

- Communications

- Compliance consultant

- Human resources consultancy

- Logistics consultancy

- Office services

- Procurement consultancy

- Project management

- Quality assurance

- Risk management consultancy

Creative industries and media

- Design consultancy

- Draughtsman

- Computer-aided design

- Fashion design

- Interior design

- Journalist

- Product design

- Textile consultancy

- Videography

Environment, food and infrastructure

- Agricultural consultancy

- Animal & wildlife consultancy

- Arboriculture

- Cartography

- Environmental consultancy

- Fisheries consultancy

- Food hygiene consultancy

- Food industry consultancy

- Forestry consultancy

- Horticultural consultancy

- Planning consultancy

- Traffic consultancy

- Transport consultancy

Education and career services

- Language schools

Other services

- Counselling/advice centre

- Other consultancies

- Research consultancy

- Trade association

- Travel consultancy

![]()

We do not cover

Sorry, we’re currently unable to insure the following.

For property and liability covers only, we exclude

- Adult education centres

- Drama school

- Fashion design

- Party planners

- Photography

- Photography – commercial

- Videography

Travelers advantage

In a dynamic world, things don’t always go to plan. Travelers offers expertise you can count on to address diverse risks thanks to a detailed and bespoke underwriting process.

- Financial strength. Financial strength and stability with international reach.

- Experience & expertise. Long-term industry experience combined with deep specialist underwriting expertise.

- In-house legal services. In-house law firm that works with customers on claims where legal action is being taken against them.

- eTrade Product – MyTravelers®. Product is available to eTrade on the MyTravelers portal.

- eTrade Product – Acturis. Product is available to eTrade on Acturis.

Advantage spotlight

You’ll be keen to know about the following.

Travelers’ SME professional indemnity (PI) combined is bespoke PI insurance for small businesses that is designed to support SMEs in non-regulated and tech professions. By combining the benefits of several key business insurances, we can protect small and medium-sized businesses – and their people, services, data and premises – from a wide range of risks and liabilities. And, to make it easier on brokers and faster for their clients, Travelers’ SME PI combined insurance is available to quote and bind with all the speed and convenience of eTrade on the MyTravelers web portal, or via Acturis.

Our dedicated SME team is made up of experienced, specialist underwriters who understand the challenges small businesses face. Their work is complemented by the expertise of our Claims team, which draws upon decades of claims handling experience and claims data to anticipate SMEs’ needs.

With a deep understanding of the sectors we cover and their unique risks, Travelers maintains market-leading coverage quality whilst offering flexible policies, so businesses pay only for what they need. The result is practical, helpful, appropriate coverage that saves brokers and SMEs both time and effort.

SME professional indemnity combined

We’re big on SME

We’ve brought our specialist mid-market expertise to the SME space. Delivering the same comprehensive cover and outstanding service you’ve come to expect from us, it’s designed to suit the needs of smaller businesses.

With both the capacity and the product suite to partner with SMEs for the long-term, we can offer support from humble beginnings to bigger things.

And because we’re all about insuring ambition, you’ll always be confident that the growth mindset of you and your clients will be fully matched by our own.

SME professional indemnity combined covers & highlights

-

Public & product liability

-

- Accidental injury to visitors, such as clients, contractors or suppliers, or damage to their belongings at the insured premises

- Accidental injury to third parties or damage to their property when away from insured premises

- Product cover for the sale or supply of defective products; covering accidental injury or property damage

- Ability to add U.S. cover if the insured works with, or has customers in, the U.S.

- Compensation for court attendance in defending a claim

- Legal cost for prosecution of any statutory legislation, e.g., Health and Safety at Work etc. Act 1974

- Covers employees abroad for business, including in a personal capacity

- Claims brought under the Defective Premises Act 1972 for a premises used to run the insured’s business (excludes injury to an employee)

-

-

Employers’ liability

-

- Standard policy limit: £10 million

- Broad definition of ‘employee’, including volunteers, people on work experience, and seasonal staff

- Compensation for employee’s injuries and the insured's legal costs

- Compensation for court attendance in defending a claim

- Legal cost for prosecution of any statutory legislation, e.g., Health and Safety at Work etc. Act 1974

- Injuries to employees caused by a terrorist act, up to the limit required by law

-

-

Contents

-

- Damage to property in the insured's office, including equipment, furniture, machinery, stock, glass, signs, works of art and more

- Visitors’ and employees’ personal effects on the insured’s premises

- Full theft cover during office hours

- Contents temporarily away from the office while at exhibitions, rental storage or computer equipment at third-party premises

- Portable equipment away from the office

- Goods in transit cover in the UK

- Rent the insured must pay if required by their lease if the property cannot be used following damage

- Computer breakdown cover including cost of reinstalling insured’s software and data

- Money cover both on and away from the premises

- Personal accident assault following the theft or attempted theft of money

-

All risk cover, including

- Fire

- Lightning strike

- Aircraft

- Storm

- Flood

- Water leaks

- Theft or attempted theft

- Explosion (caused by gas leaks, etc.)

- Earthquake

- Vandalism

- Vehicle collisions with the building

- Accidental damage

- Subsidence

-

-

As standard we offer these policy extensions

-

- Directors’, partners’, employees’ and visitors' personal effects

- Signs, glass and sanitary ware

- Keys and locks

- Refrigerated stock

- Incompatibility of computer records

- Outsourced service providers

- Works of art and precious metals

- Fixed contents at home of partners, directors and employees

- Outdoor trees and landscaping

- Clearance of drains

- Trace and access

- Loss of metered water, gas, oil and electricity

-

-

Buildings

-

- Repair or replacement of damaged property

- If the insured owns the building and leases out part of it, we will cover the lost rent that would normally be payable to the insured during a period of unoccupancy following damage to the building

- Automatic provisional cover to newly acquired property until details are supplied

-

The structure of the building, such as

- Roof

- Walls

- Ceiling

- Floors

- Doors

- Windows

- Fitted fixtures

- Sanitary suites

- Signs

- Outbuildings

- Gates

- Fences

- Mains supply pipes

- Drains

-

All risk cover, including

- Fire

- Lightning strike

- Aircraft

- Storm

- Flood

- Water leaks

- Theft or attempted theft

- Explosion (caused by gas leaks, etc.)

- Earthquake

- Vandalism

- Vehicle collisions with the building

- Accidental damage

- Subsidence

-

-

Business interruption

-

- Automatically includes 25% of business interruption loss of income sum insured as increased cost of working (ICOW)

- Prevention of access to insured’s business premises due to damage within a one-kilometre radius of the premises

- Poisoning from food or drink supplied at or from the premises

- Loss in transit within the UK

- Loss of property stored within the UK

-

Loss of income while the insured is unable to trade due to property damage by a range of causes, including

- Fire

- Lightning strike

- Aircraft

- Storm

- Flood

- Water leaks

- Theft or attempted theft

- Explosion (caused by gas leaks, etc.)

- Earthquake

- Vandalism

- Vehicle collisions with the building

- Accidental damage

- Subsidence

-

Closure of premises from

- Murder, manslaughter, suicide or sudden physical injury at the premises

- Defects to drains or other sanitary arrangements

- Vermin or pest infestation

-

Damage to the premises of the insured's

- Electricity, gas, water or telecommunications provider, including the connecting pipes and cables to their premises

- UK-based suppliers of goods

- Supplier of outsource services

-

-

Terrorism cover

-

- Terrorism cover is available in England, Wales or Scotland to cover the damage to buildings, contents and business interruption

-

Cyber cover spotlight

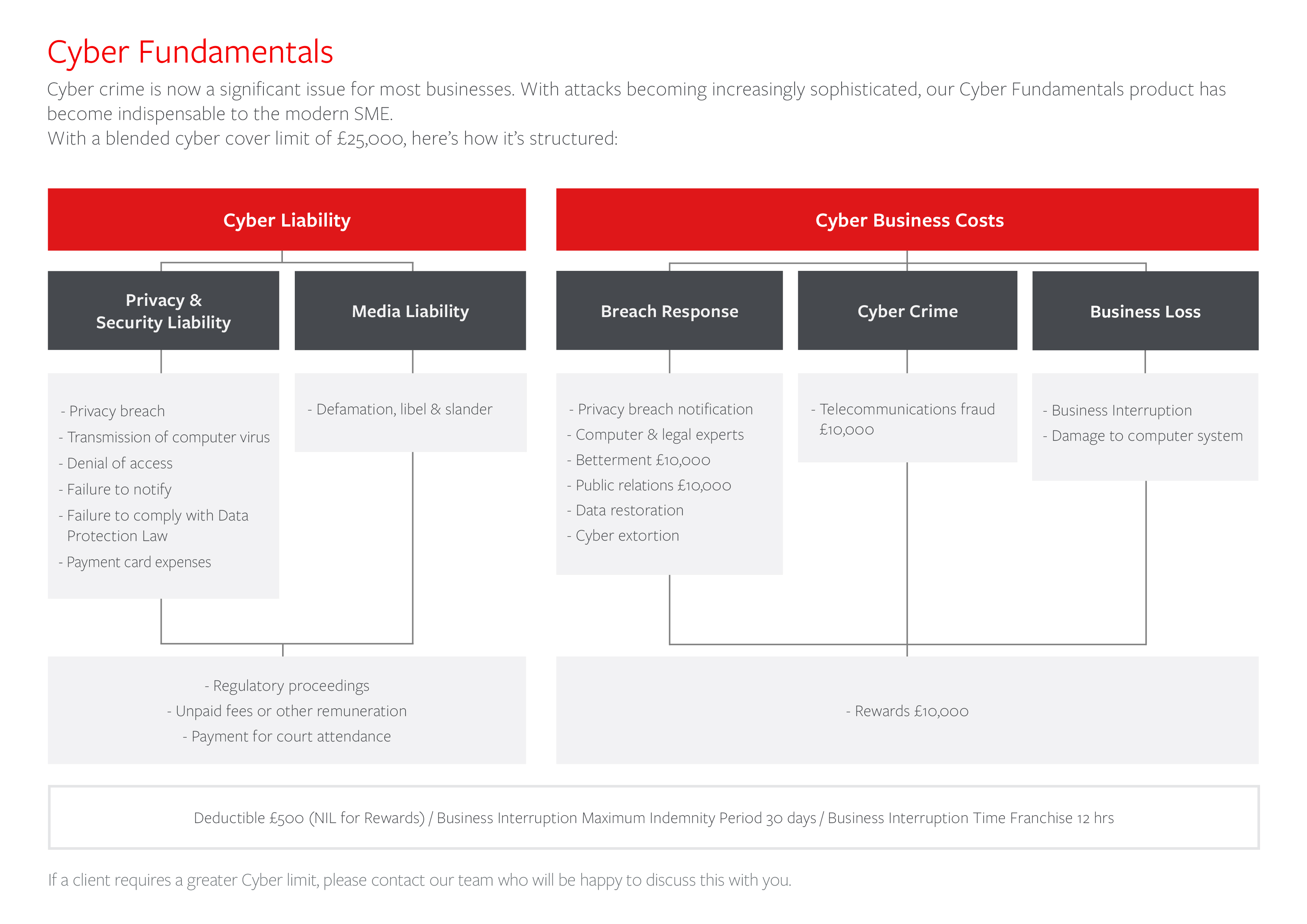

Cyber crime is now a significant issue for most businesses. With attacks becoming increasingly sophisticated, our Cyber Fundamentals product has become indispensable to the modern SME.

With a blended cyber cover limit of £25,000, here’s how it’s structured:

This cover combines cyber liability insurance with cyber business costs insurance.

Cyber liability insurance combines coverage of privacy and security liability with media liability coverage. Privacy and security liability covers include privacy breach, transmission of computer virus, denial of access, failure to notify, failure to comply with data protection law and payment card expenses. Media liability covers include defamation, libel and slander. Both privacy and security liability and media liability cover regulatory proceedings, unpaid fees or other remuneration, plus payment for court attendance.

Cyber business costs insurance combines coverage of breach response, cyber crime and business loss. Breach response covers include privacy breach notification, computer and legal experts, betterment up to £10,000, public relations up to £10,000, data restoration and cyber extortion coverage. Cyber crime cover includes telecommunications fraud up to £10,000. Business loss covers include business interruption and damage to computer systems. Breach response, cyber crime and business loss all reward up to £10,000.

Other details: General deductible is £500 (nil for rewards). Business interruption maximum indemnity period is 30 days. Business interruption time franchise is 12 hours.

If a client requires a greater cyber limit, please contact our team who will be happy to discuss this with you.

Add-ons & extensions

These items may be available to add on to your policy

Legal expenses

If and when a company must defend a claim, legal expenses cover can help protect your business and employees during everyday legal disputes, providing support, advice and cover against legal costs.

Related products

SME cyber

Whatever the size of a business, cyber security is vital. Our services, covers and expertise can mitigate cyber attacks and help prevent them.

SME property owners

Our products for small to medium enterprise (SME) property owners deliver the kind of comprehensive cover and outstanding service you’ve come to expect from us, thoughtfully tailored for small businesses.

Let’s start the right conversation

For business

Find a broker

If you’re looking for covers and have a broker, ask about Travelers products.

If you need a broker, start with the right broker directory.

Need to call us directly? Contact us.

For brokers

Ready to chat?

Let’s work together to build the right cover for your client.

Available to eTrade

Log in to MyTravelers® or Acturis.

MyTravelers

MyTravelers is a dedicated web platform for registered brokers.

Have a new business idea? Contact our Schemes team.

Related services

Risk services

Businesses aren’t all alike. That’s why Travelers provides superior risk management services tailored to a company’s specific needs.

Claims services

When claims happen, our best-in-class service helps to resolve them quickly and effectively, so clients can get back to business.

Insights & industry knowledge

Articles to help your ambition succeed

Small and Medium-Sized Enterprises (SME) Resources

Travelers is Expanding eTrade and SME Insurance Solutions

Jonathan Forster shares how Travelers is growing our eTrade and SME insurance solutions with our team of experts. Learn more about Travelers' growing range of products.

Small and Medium-Sized Enterprises (SME) Resources

Smaller Management Consultancies May Underestimate This Key Protection

The management consulting profession is currently in a state of flux – and it’s generating uncertainty for both consultants and the businesses that need their expertise.

Small and Medium-Sized Enterprises (SME) Resources

Protecting SME Businesses, in Good Times and Bad

Running a small business isn’t easy – particularly in this economic climate.