Legal Expenses Insurance

Helping businesses cover prohibitive legal costs

Even when business is going well, a company can face a broad range of legal challenges. Situations can vary from disputes with staff to issues with commercial tenancy agreements. Should the need arise to defend a claim, our legal expenses insurance can protect against the associated costs.

Designed to help protect your business and employees during everyday legal disputes, Travelers legal expenses insurance provides support, advice and cover against legal fees. Underwritten by ARAG Legal Expenses Insurance Company Limited, this policy includes cover for solicitors’ and barristers’ fees, court costs, expenses for expert witnesses, attendance expenses and accountants’ fees. It will also pay the costs of appealing or defending an appeal.

Travelers Legal Expenses cover is included at no extra cost for SME automotive and health & care policyholders. It’s also an optional paid add-on for customers with an automotive, technology, education, office, property owners, SME professional indemnity combined, SME office or SME property owners policy.

Legal expenses covers & highlights

Partnered with ARAG to provide legal expenses cover

Travelers is partnered with ARAG, the UK’s leading legal expenses insurer, to cover claims of up to £250,000 for policyholders across many of our insurance products. Events covered by ARAG include:

-

Costs arising from any legal disputes around

- Employment

- Contracts

- VAT

- Commercial tenancy agreements

-

Employees called to jury duty

-

Legal problems with tax compliance

-

An allowance in the event an employee is called to court as a witness

ARAG provides:

-

Unlimited access to legal and tax helplines

-

Unlimited use of an online legal document drafting tool

-

Exclusive discounts on additional pay-as-you-go legal services, e.g., reviewing contracts

ARAG will also:

-

Find a specialist lawyer to act on a policyholder’s behalf

-

Pay a policyholder’s lawyer to cover legal costs, including the other side, if a case is lost

-

Pay employment compensation awards

For more information, visit the ARAG website.

-

Employee disputes

-

Health and safety issues or prosecution

-

Property damage, tenancy agreement disputes, nuisance or trespass

-

Contract dispute over the sale or purchase of goods and services

-

His Majesty’s Revenue & Customs tax enquiry

Related products

Education

Educational institutions frequently face the possibility of property damage or liability. Travelers can help create tailored protection for an institution’s most significant exposures.

Health & care

We’re one of the few specialised insurers that delivers bespoke solutions to organisations providing care and health advice and treatment. This includes clinics, care facilities, charities and hospitals.

UK property owners

In addition to protecting property from fire and theft, storms, and floods, this specialist policy can also cover key exposures for property owners, including subsequent loss of rent and public and employers’ liability.

Technology

As the technology sector changes, insurance protection needs to evolve with it. Travelers can help anticipate potential risks so clients have more freedom to innovate.

Let’s start the right conversation

For business

Find a broker

If you’re looking for covers and have a broker, ask about Travelers products.

If you need a broker, start with the right broker directory.

Need to call us directly? Contact us.

Insights & industry knowledge

Articles to help your ambition succeed

Workplace Safety Resources

Creating a Safety Culture in the Workplace

Advice on how to create a safety culture in the workplace.

Workplace Safety Resources

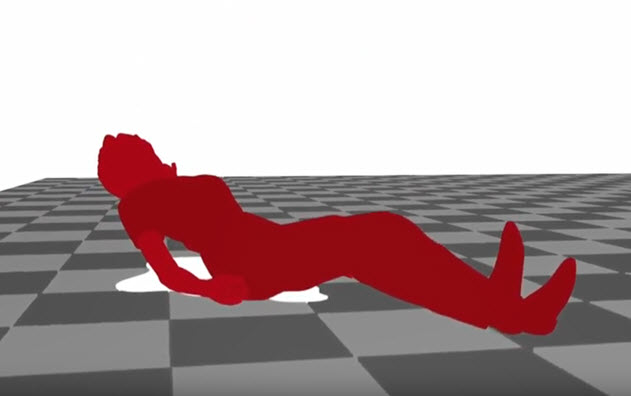

How to Prevent Slips, Trips and Falls

Following these health and safety practices can help prevent workplace injuries.

Workplace Safety Resources

Unoccupied Business Premises

Travelers Risk Management guidance for unoccupied business premises.