Hotel Insurance

Enabling hotels to reach higher

To compete in an ever-growing industry, hotels must improve and add to their services whilst minimising and managing the risks involved. Travelers’ expertise offers the comfort of cover across varied risks, allowing hoteliers to focus on what really matters.

With our global industry specialists on hand to anticipate issues, hoteliers can seize opportunities without worrying about hotel insurance. Whether a hotel faces simple or complex risks, we underwrite its cover individually to meet specific needs and priorities. Our expert risk managers will take the time to advise about current and emerging risks, whilst our dedicated claims team is standing by to provide knowledgeable support if something goes wrong.

Our appetite

![]()

We cover

These fall within our appetite, and we’re happy to discuss details.

- Modern purpose-built city/town centre hotels with limited leisure facilities (e.g., a bar)

- Modern purpose-built hotels with limited leisure facilities that aren’t the main attraction (e.g., a pool)

![]()

We do not cover

Sorry, we’re currently unable to insure the following.

- Country hotels

- Resort/spa hotels

Hotel covers & highlights

-

Standard

- Property damage

- Business interruption

- Computer damage

- Terrorism

- Employers’ liability

- Public and products liability

- Legal expenses

-

Optional

- Goods in transit

- Money and personal accident (assault)

- Deterioration of stock

- Loss of licence

- Outstanding debit balances

Add-ons & extensions

These items may be available to add on to your policy

- Chefs' knives

- Condemnation of undamaged property

- Outside catering

- Restaurant wine stock

- Unavoidable betterment of machinery

- Head chef (this cover provides gross profit/revenue cover in the event of the death/permanent disablement of the head chef of a restaurant operation. Some restaurants have a well-regarded chef, and their ability to perform can be a large part of the success of restaurant operations.)

- Deterioration of stock

- Specific attack, including denial of service

- Bomb (hoax or actual)

- Infectious disease

- Loss of attraction

- North American jurisdiction

- Pre-claim rehabilitation costs

- Hotel Proprietors Act

- Libel and slander

- Hotel golf course extensions

- Fine arts

- Grounds maintenance equipment (theft)

- Beauty, fitness and well-being treatment

- Licence definition

- Valet parking

Let's get specific

These are the kinds of detailed questions we will ask to better understand day-to-day operations.

- Do the buildings have fire suppression?

- Are there any listed buildings?

- What amenities are provided (e.g., leisure, entertainment, spa facilities or sale of alcohol)?

- Are there amenities provided for children (e.g., crèches, baby-sitting or baby listening)?

- Who provides these amenities?

- Is valet parking offered?

- Does the premises host functions (e.g., weddings, exhibitions, etc.)?

- What is the cleaning regime and Legionella controls?

- Is there outside catering or tableside cooking?

- Is there live entertainment, dance floor or other types of entertainment (e.g., cabaret, plate smashing, etc.)?

- Is there a tronc arrangement in effect?

- Are there extended opening hours for drinks service (e.g., beyond midnight)?

Questions about the course

- How many holes does the course have?

- Does someone live at the premises/on the course?

- How far are the green keepers’ sheds from the main complex?

- Is the course under construction?

Questions about the club

- Is the club a private members’ club?

- How many active members are there?

- How long has the club been established?

Related products

Leisure

The hospitality industry faces complex risks. As a business evolves, it’s important to continually protect against the hazards guests may encounter on a company’s property.

Museums & galleries

Curators and custodians of cultural treasures know there’s more on the line than the integrity of collections. We offer covers for a variety of special exposures.

Visitor attractions

For attraction companies, seeing the delight of their visitors can be enhanced knowing cover is in place for the specific variety of incidents that can occur at a destination.

Leisure activities

As leisure businesses work to enhance customer loyalty, build revenue and offer the best experiences in their industry, we offer covers for the varied risks they may encounter.

Employers’, public & products liability

Our products can provide cover for companies involved in a range of trades of all sizes, including those with locations and activities overseas.

Cyber

Every company faces cyber threats and risks. Cyber cover helps businesses deal with the increasing complexity of digital crime.

Let’s start the right conversation

For business

Find a broker

If you’re looking for covers and have a broker, ask about Travelers products.

If you need a broker, start with the right broker directory.

Need to call us directly? Contact us.

For brokers

Let’s save some time

Let’s work together to build the right cover for your client. Your local Travelers office is the best starting place for this. You can find them listed here.

Insights & industry knowledge

Articles to help your ambition succeed

Workplace Safety Resources

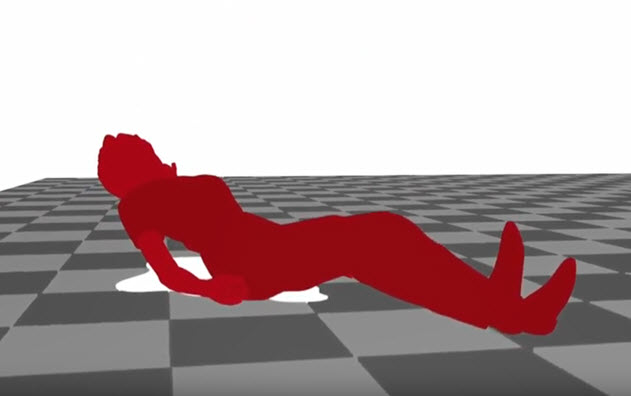

How to Prevent Slips, Trips and Falls

Following these health and safety practices can help prevent workplace injuries.

Weather Safety Resources

Rain and Flooding

Businesses in areas at risk for flooding need a plan to prepare and restore their operations.

Cyber Security Resources

Why Buy Standalone Cyber Insurance?

Cyber breaches continue to be a pervasive and evolving problem for businesses of all sizes.