Employers’, Public and Products Liability Insurance

Protecting your business from the potential financial impact of liability claims

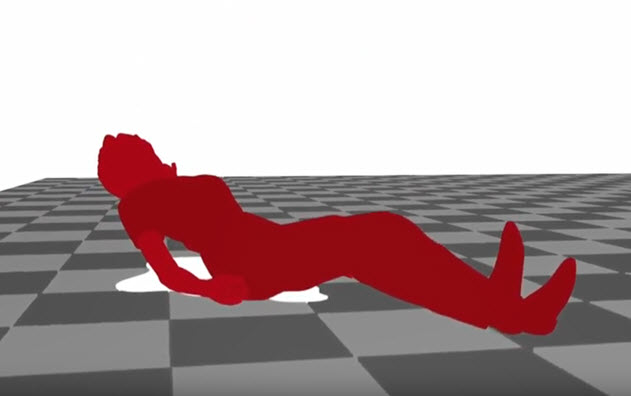

In today’s increasingly litigious environment, businesses can face financially devastating claims where they are held legally liable for accidents causing injury or damage to property, employees, members of the public, business partners and customers. Businesses face significant challenges navigating liability risk and protecting against the financial consequences it presents.

We have many years of experience providing protection to businesses and helping them manage liability risk. We offer both stand-alone and packaged solutions, which encompass employers’, public and products liability insurance – along with claims and access to risk control experts.

Employers’ liability, which is compulsory for most businesses in the UK, covers the costs of compensating employees who are injured or made ill by the work they carry out for the business.

Public and products liability, although not a compulsory requirement, is often essential. It covers the costs of compensating members of the public where they sustain injury or damage to their property whilst on the insured's premises, when the insured is working away in the course of their business or when they’re using a product purchased from the insured.

Travelers employers’ liability and public and products liability packages can provide cover for companies involved in a range of trades and of all sizes – including those with locations and activities overseas. Coverage can be offered on a ground up, deductible or other non-conventional basis.

Our appetite

Whilst employers’ liability and public and products liability are typically purchased as part of combined business insurance packages, we at Travelers will also consider providing coverage on a stand-alone basis.

Travelers advantage

In a dynamic world, things don’t always go to plan. Travelers offers expertise you can count on to address diverse risks.

- Financial strength. Financial strength and stability with international reach.

- Experience & expertise. Long-term industry experience combined with deep specialist underwriting expertise.

- Superior claims service. Expert Claims teams focused on delivering superior service.

- Dedicated risk managers & consultants. Access to risk consulting from trusted experts.

- Multinational reach. Tailored coverage and support in more than 150 countries.

- Rehabilitation. Aid injured employees return to work with Travelers Proactive Rehabilitation Support.

- Legal sector enhancements. Enhanced Office cover for the legal industry.

- Safety Academy. Access to Institute of Occupational Safety and Health Managing Safety classroom courses.

- In-house legal services. In-house law firm that works with customers on claims where legal action is being taken against them.

- Criminal Protection Response. 24/7/365 support for threat and hostage situations.

- eTrade Product – MyTravelers®. Product is available to eTrade on the MyTravelers portal.

- eTrade Product – Acturis. Product is available to eTrade on Acturis.

Advantage spotlight

You’ll be keen to know about the following.

With more than 50 years of experience in the UK market, we know employers’ liability insurance and public and products liability insurance. Backed by our financial strength ratings, Travelers has built a solid foundation and reputation that allows us to offer covers to address the needs of our customers.

Our highly qualified underwriters work closely with brokers to assess their clients’ business insurance arrangements to ensure they are protected against the range of risks that can lead to claims. Our risk managers can help introduce practices that minimise exposures, and in the event incidents occur, our claims professionals partner closely with the business to ensure claims are resolved with minimal disruption.

Employers' and public and products liability covers & highlights

Public liability

-

Amounts payable to

- Third parties, as compensation, who have been injured or have sustained damage to their property whilst on the insured's premises, when the insured is working away in the course of their business or when they’re using a product purchased from the company

-

Legal costs, including those for defendants and claimants

- For claims from those who have been injured or have sustained damage to their property whilst on the insured's premises, when the insured is working away in the course of their business or when they’re using a product purchased from the company

-

Compensation for court attendance

- If principal partners, directors or any other employee are required to attend a court, tribunal or other forum as witnesses in connection with a covered claim

-

Consumer Protection Act 1987, Health and Safety at Work Act 1974 or Northern Ireland Order 1978, Food Safety Act 1990, Corporate Manslaughter and Corporate Homicide Act 2007 Defence Costs

- Legal costs and expenses reasonably incurred in the defence of criminal proceedings or for an appeal against conviction in respect of a breach

-

General Data Protection Regulations (GDPR)

- Compensation, claimant’s costs and expenses and reasonable defence costs and expenses incurred for damage or distress under Article 82 of the GDPR and reasonable defence costs relating to a prosecution under the GDPR in relation to a claim made by any person

-

Motor contingent liability

- For insured’s legal liabilities when a motor vehicle, not owned or provided by them, is used in connection with the business

-

Overseas personal liability

- Legal liability of employees and accompanying family members which has been incurred in a personal capacity whilst working for the insured outside of the policy’s territorial limits

-

Defective Premises Act

- Legal liabilities which have been incurred under the Defective Premises Act 1972 or Defective Premises (Northern Ireland) Order 1975 for premises which were previously owned and utilised for their business

Employers’ liability

-

Amounts payable in respect of compensation to

- Employees who suffer injury or illness whilst working for the insured

-

Legal costs, including those for defendants and claimants

- For claims from employees who have been injured whilst working in the course of business

-

Compensation for court attendance

- If principal partners, directors or any other employees are required to attend a court, tribunal or other forum as witnesses in connection with a covered claim

-

Temporary work overseas

- For occasions when employees suffer injuries when engaged in business activities outside of the normal territorial limits

-

Unsatisfied court judgements

- Obtained by employees for bodily injury caused during the period of insurance and in the course of employment, against third parties which remain outstanding, after six months

-

Health and Safety at Work Act 1974 / Northern Ireland Order 1978, Corporate Manslaughter and Corporate Homicide Act 2007 Defence Costs

- Legal costs and expenses reasonably incurred in the defence of criminal proceedings or for an appeal against conviction in respect of a breach

-

Proactive Rehabiliation Support (PRS)

- Supports employers getting employees back to work, by providing access to rehabilitation services following accidental bodily injury sustained at work

Add-ons & extensions

These items may be available to add on to your policy

Add-ons

- Property and business interruption

- Goods in transit

- Computer cover

- Money and personal accident

- Terrorism for property and business interruption

Add-ons for select products

- Legal expenses

- Fidelity guarantee

- First-party cyber

- Third-party cyber

- Professional liability/professional indemnity

- Automotive (road risks)

- Computer breakdown

- Deterioration of stock

- Criminal protection response

- Product recall – costs only

- Governors and officials indemnity

Extensions for public and products liability only

- Libel and slander: compensation for injury incurred by way of slanders or libels

- Pollution clean-up costs instigated by a regulatory authority: commonly referred to as Bartoline cover, this extension provides an indemnity for statutory clean-up costs required or ordered by a regulatory authority, as a result of pollution of land or water caused by a sudden and accidental event, outside of the premises of an insured within the standard territorial limits

- For global programs we offer difference in conditions, difference in limit, excess and residual employers' liability to provide a seamless global master policy solution

- Cover for legal liability to members of the public sustaining injury or property damage resulting from a terrorist event

Related products

Management liability

When losses and lawsuits pose professional and personal risks to a company’s leaders, management liability insurance can help them stay focused on running the business.

Directors & officers

Travelers offers broad, flexible directors’ and officers’ insurance through our expert underwriting team as well as our online platform.

Aviation & space

As one of the leading providers of specialist aviation insurance in the Lloyd’s market, we can deliver creative solutions for unique risks.

Crisis management

Our Crisis Management team helps ensure clients have the security to take on desired challenges. We take pride in our technical underwriting, risk consulting and professional claims capabilities.

Energy & renewables

Our worldwide cover insures risks of direct physical loss or damage to companies involved in electricity generation, electricity distribution, and traditional and renewable energy.

International marine

For those doing business in international waters, our highly experienced team can offer a wide range of comprehensive and competitive solutions that cover the length and breadth of the industry.

Personal accident

Travelers provides coverage worldwide for personal accident and travel, and is available to companies, individuals, sports teams or affinity groups as a stand-alone or as part of an insurance package.

Let’s start the right conversation

For business

Find a broker

If you’re looking for covers and have a broker, ask about Travelers products.

If you need a broker, start with the right broker directory.

Need to call us directly? Contact us.

For brokers

Ready to chat?

Let’s work together to build the right cover for your client. Your local Travelers office is the best starting place for this. You can find them listed here

Available to eTrade

Log in to MyTravelers® or Acturis.

MyTravelers

MyTravelers is a dedicated web platform for registered brokers.

Related services

Risk services

Businesses aren’t all alike. That’s why Travelers provides superior risk management services tailored to a company’s specific needs.

Claims services

When claims happen, our best-in-class service helps to resolve them quickly and effectively, so clients can get back to business.

Insights & industry knowledge

Articles to help your ambition succeed

Workplace Safety Resources

Creating a Safety Culture in the Workplace

Advice on how to create a safety culture in the workplace.

Cyber Security Resources

Cyber Security Training for Employees

Tips on employee cyber security training from Travelers.

Workplace Safety Resources

How to Prevent Slips, Trips and Falls

Following these health and safety practices can help prevent workplace injuries.