Energy and Renewables Insurance

Helping you champion a brighter future

Powering the future

As a global insurance leader in both traditional and renewable energy sectors, Travelers is playing a key role in the transition to a more sustainable future. With innovative oil and gas companies driving most of today’s production to the rapidly expanding renewables sector, Travelers offers a mix of energy insurance products that continually evolve to help support and advance the dynamic market. Our Lloyd’s energy economy underwriters have the technical expertise to help you champion a brighter future.

Explore energy and renewables subsectors

Power & utilities

For businesses involved in the transmission and distribution of electricity and gas, Travelers can provide cover that helps mitigate risk and minimise loss.

Renewables

We can help resolve complex claims quickly with our specialist cover for companies that develop renewable energy assets and services.

Upstream & midstream

With the technical expertise of our energy underwriters, clients can manage oil and gas sector risks and be advised on safety practices.

Travelers advantage

In a dynamic world, things don’t always go to plan. Travelers offers expertise you can count on to address diverse risks thanks to a detailed and bespoke underwriting process.

- Financial strength. Financial strength and stability with international reach.

- Experience & expertise. Long-term industry experience combined with deep specialist underwriting expertise.

- Superior claims service. Expert Claims teams focused on delivering superior service.

- Multinational reach. Tailored coverage and support in more than 150 countries.

Let’s start the right conversation

For business

Find a broker

If you’re looking for covers and have a broker, ask about Travelers products.

If you need a broker, start with the right broker directory.

Need to call us directly? Contact us.

Speciality claims FAQs

Review these FAQs to gain familiarity with energy and renewables claim requirements

Claims are initially reported by email with a follow up phone call. Formal notification is then placed via Electronic Claim File (ECF2).

LOPI stands for Loss of Production Income. It is a type of insurance to cover loss of production following an unexpected interruption due to an insured event under the policy. LOPI would recover the fixed unit price at the agreed volumes for the insured period subject to a waiting period, which can vary in length. There could also be cover for increased cost of working and control of well costs.

Travelers would consider instruction of counsel in matters where there are coverage concerns and/or litigation has been commenced against the insured or another covered entity. These decisions will be made on per-case basis.

The Travelers dedicated Subrogation Team can assist with your recovery requirements. Although some documentation and additional evidence may be required from the insured, the Subrogation Team will work with the relevant Claims Professional to manage recoveries against any responsible third parties, which may include utilisation of external experts. Travelers will ensure that the best result is achieved.

For approved claim payments made via the Lloyd’s of London bureau, payments will be made direct from insurers to London brokers through DXC, with the payment process taking approximately three working days. Any approved non-bureau claim payments would be made direct from Travelers to either the local broker or end customer via wire transfer and can be made the same day. For lead business, your designated CRM team member can discuss the process.

Related services

Risk services

Businesses aren’t all alike. That’s why Travelers provides superior risk management services tailored to a company’s specific needs.

Claims services

When claims happen, our best-in-class service helps to resolve them quickly and effectively, so clients can get back to business.

Insights & industry knowledge

Articles to help your ambition succeed

Workplace Safety Resources

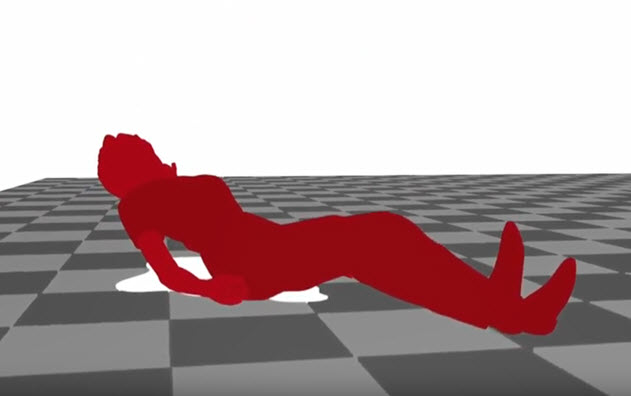

How to Prevent Slips, Trips and Falls

Following these health and safety practices can help prevent workplace injuries.

Workplace Safety Resources

Creating a Safety Culture in the Workplace

Advice on how to create a safety culture in the workplace.

Workplace Safety Resources

Using Contractors

Travelers Risk Control provides guidance for businesses that appoint contractors.