Aviation Insurance

The right aviation and space insurance is just the beginning

You can support your organisation’s ambition with Travelers specialty aviation insurance in the Lloyd’s market. Our aviation team has a reputation for delivering creative and customised solutions with each client’s unique risk management needs. We’re one of the leading providers of aviation liability insurance coverage for general aviation and aerospace. Travelers Syndicate 5000 is also one of the few insurers to support the commercial satellite sector, providing specialist space insurance during launch and operational phases.

Our experienced and highly knowledgeable aviation underwriters work closely with clients on safety management systems and quality assurance to enhance risk management. We can provide major classes of coverage as well as related products to complete the package.

Explore aviation subsectors

Aerospace

Our experienced aerospace underwriters have a high degree of specialist industry knowledge and can tailor cover to a range of exposures.

Airlines

With specialist underwriting expertise and dedicated claims management, we cover passenger and cargo airline operations, from single aircraft to large fleets.

General aviation

With a track record that includes covers from single aircraft to fixed and rotor wing fleets, we’re an established leader in aviation insurance.

Travelers advantage

Travelers is a well-established aviation insurer and reinsurer with a worldwide account covering the aerospace industry risk, from niche suppliers to international Fortune 500 enterprises.

- Financial strength. Financial strength and stability with international reach.

- Experience & expertise. Long-term industry experience combined with deep specialist underwriting expertise.

- Superior claims service. Expert Claims teams focused on delivering superior service.

- Multinational reach. Tailored coverage and support in more than 150 countries.

Advantage spotlight

You’ll be keen to know about the following.

Our clients also benefit from the financial strength and stability that comes from being part of Lloyd’s. With strong financial security every policy is supported by an A (excellent) rating from the rating agency A.M. Best, AA- (strong) rating from Standard & Poor’s and AA- (very strong) rating from Fitch Ratings. This strong security allows us to offer 100% lines on specialist Aerospace risks within this sector.

Let’s start the right conversation

For business

Find a broker

If you’re looking for covers and have a broker, ask about Travelers products.

If you need a broker, start with the right broker directory.

Need to call us directly? Contact us.

Speciality claims FAQs

Review these FAQs to gain familiarity with aviation and space claim requirements

Claims are initially reported by email with a follow up phone call. Formal notification is then placed via Electronic Claim File (ECF2).

Travelers operates a list of vetted and approved external service providers (ESPs) to ensure the correct expertise can be instructed based on the complexities of the claim.

NACHA stands for North American Claims Handling Agreement. It is a memorandum of agreement between several insurers relating to the claims handling procedures and limits in connection with aviation liability and/or aircraft physical damage insurance.

A letter of authority (or LOA) is a document used to reach an agreement between three or more parties. It's a special permission slip you can give to a broker that allows them to speak with other insurers and businesses on your behalf within an agreed limit.

Yes. In the UK and the U.S., you must make an air accident claim within two years of the incident occurring that you are claiming for. Although in some special circumstances, a claim can be made within six years from the date of the incident.

Aircraft insurance policies may have liability sub-limits applicable to each passenger. These sub-limits are the most that the insurer will pay for each passenger’s claim for bodily injury. A combined single limit of liability (or smooth limit) means that no sub-limits would apply; cover would therefore be restricted by the full policy limit only.

For approved claim payments made via the Lloyd’s of London bureau, payments will be made direct from insurers to London brokers through DXC with the payment process taking approximately three working days.

Any approved non-bureau claim payments would be made direct from Travelers to either the local broker or end customer via wire transfer and can be made the same day. Your designated customer relationship management (CRM) team member can discuss this process for lead business.

Related services

Risk services

Businesses aren’t all alike. That’s why Travelers provides superior risk management services tailored to a company’s specific needs.

Claims services

When claims happen, our best-in-class service helps to resolve them quickly and effectively, so clients can get back to business.

Insights & industry knowledge

Articles to help your ambition succeed

Cyber Security Resources

Cyber Security Training for Employees

Tips on employee cyber security training from Travelers.

Workplace Safety Resources

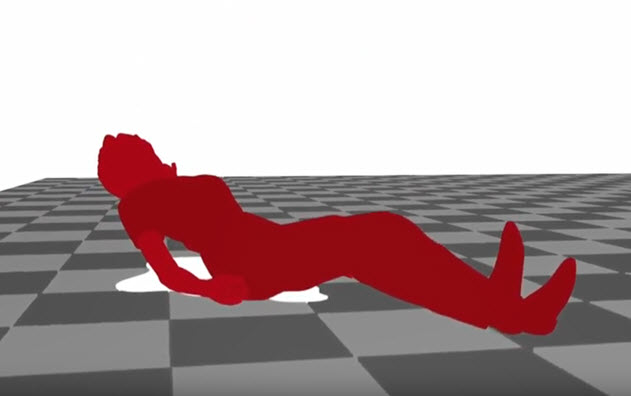

How to Prevent Slips, Trips and Falls

Following these health and safety practices can help prevent workplace injuries.

Workplace Safety Resources

Unoccupied Business Premises

Travelers Risk Management guidance for unoccupied business premises.