Start a Claim for Motor and Windscreens

Prompt submissions enable quick decisions

Speed of reporting new motor claims to insurers is what helps keep costs low. It enables us to capture incident details and help arrange repairs and alternative vehicles where needed as quickly as possible before hefty credit hire charges are incurred.

At Travelers we have a specific two-hour Service Level Agreement in place for responding to motor claims which applies during standard business working hours (9 a.m. to 5 p.m.) on standard working days (excluding holidays). This enables us to quickly capture cases that may be considering credit hire and redirect the claims to an alternative solution.

Our recommendation to all Travelers customers is that they promptly report a motor claim to us. Our dedicated Motor First Notification of Loss team are ready to receive details of claims to proactively work to instigate repairs, arrange alternative transport where required, and confirm liability as swiftly as possible to help ensure that claim costs are kept to a minimum.

Urgent claims

In an emergency, please call our free 24/7 hotline immediately.

- We are ready to receive the details of your claim

- Please quote your policy number

CALL +44 (0)800 587 8388 (option 1)

Non-urgent claims

If it’s not an emergency, please send an email as close to the date of incident as possible.

You’ll need the following information to start a claim:

- Your name/company name

- Your policy number

- Date of incident

- Incident facts and supporting documentation

A Motor First Notification of Loss team member will contact you as soon as possible to proactively work with you on potential solutions.

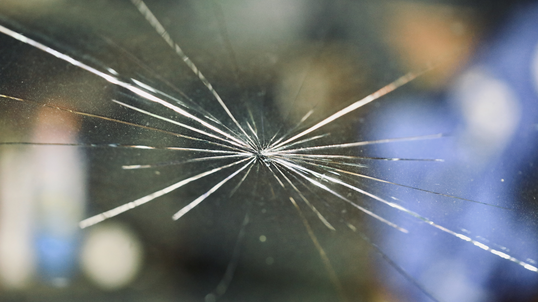

Cracked windscreen?

If the glass on your vehicle suddenly breaks, Travelers recommends using one of these preferred glass suppliers.

Got more time?

Download and send us a claims form

Download a form below, fill out the information needed and when completed email to: [email protected].

Motor accident claims

Motor fire and theft claims

Our team

The highly qualified and experienced team of Claim Professionals have handled all manner of motor claims from rear-end shunts, to multi-vehicle collisions and catastrophic injury claims.

Our team can quickly review and liaise directly with third parties and engineers. If needed, they can work collaboratively with our external loss adjusting panel to ensure a speedy resolution.

Frequently asked questions

Motor and windscreen claim FAQs

An accident report is not essential for motor claims. All that we ask is that any new incident is reported to Travelers as quickly as possible.

There are a number of ways to contact our motor claims team and report an incident.

Via app – customers using our roadside reporting app via their smartphone can report the incident via the app while at the roadside. This will provide simultaneous notification to Travelers, the customer fleet/transport manager and the broker.

Via phone – customers can also report an incident via our 24/7 freephone claim hotline: +44 (0)800 587 8388 and speak with one of our dedicated Motor First Notification of Loss Claim Professionals who will take all the details over the phone.

Via email – customers can submit details of the incident to our dedicated First Notification of Loss email address: [email protected].

Notification requirements are stated in the policy and here. This list represents circumstances that should be reported to Travelers regardless of whether a formal claim has been made at that stage:

- Any incident likely to breach 50% of your policy excess/deductible

- Death

- Serious injury

- Disease

- Adverse publicity whether actual or anticipated

- Multiple claims involving bodily injury from one incident

- Abuse, whether or not the insured is of the opinion that they will become legally liable to pay compensation

Serious injuries include but are not limited to:

- Spinal cord injury (e.g., paraplegia, quadriplegia, tetraplegia)

- Amputations – requiring a prosthesis

- Brain damage affecting mentality or central nervous system, including but not limited to:

- Permanent disorientation

- Behaviour disorder

- Personality change

- Seizures

- Motor deficit

- Inability to speak (aphasia)

- Hemiplegia or unconsciousness (comatose)

- Blindness

- Burns over 10% of the body with third degree or burns over 30% with second degree

- Multiple fractures involving more than one member or non-union

- Fracture of both heel bones (bilateral fractures of the os calcis)

- Nerve damage causing paralysis and loss of sensation in arm and hand (brachial plexus nerve damage)

- Massive internal injuries affecting body organs

- Injury to nerve at base of spinal canal (cauda equina) or any other back injury resulting in incontinence of bowel and/or bladder

To minimise inconvenience, Travelers has selected preferred glass suppliers to help ensure a prompt, safe and quality repair for our customers. We recommend that customers use these suppliers in the case of sudden or accidental glass vehicle damage or breakage.

There is no need to contact Travelers before arranging an appointment directly with a preferred supplier. To speed up the process, please have your Travelers policy details/certificate of motor insurance ready before contacting the preferred suppliers.

Contact a Travelers-preferred supplier.

If you are involved in a road traffic collision that results in your vehicle becoming undriveable, Travelers has a national arrangement with Auto-Rescue Logistics to recover insured vehicles and assist getting customers to their destination or home.

We recommend the use of Auto-Rescue Logistics for all policyholders who are comprehensively insured as a way of controlling scene of accident recovery and all associated costs. Whilst use of this service is not compulsory, these proactive arrangements can help control such costs.

If the Police or Highways Agency Officers are in attendance, please state very clearly that vehicle recovery is through Travelers Insurance arrangements with Auto-Rescue Logistics. The Police and Highways Agency will recognise this request.

Travelers customers may call the dedicated telephone number with Auto-Rescue Logistics at: +44 (0)1604 496852. Telephones are answered 24 hours a day, 7 days a week, 365 days a year.

For further details, visit Auto-Rescue Logistics.

Feedback requested

We’d be delighted to hear from you, no matter your thoughts.

Send us your claims experience feedback, and we’ll do our best to take your input into account.