Office Insurance

Travelers helps offices to run smoothly

In an increasingly complex business environment, it’s critical that an office is run efficiently and effectively. Our team has deep experience in helping manage the associated risks that can jeopardise these spaces.

That’s why we offer an office insurance product that provides comprehensive cover for a wide range of office-based activities, both professional and otherwise. Travelers can be trusted to give businesses the confidence they need to help run their offices successfully.

Explore office subsectors

SME office

By streamlining essential office policies into one easy-to-manage package, Travelers helps you cut back on labour-intensive paperwork.

Mid-market & corporate office

Our office product is designed for a wide range of professional clients, including accountants, architects, banking organisations, estate agents, secretarial services, and solicitors and legal services.

Travelers advantage

In a global and diverse business landscape, office operations don’t always go to plan. Travelers offers expertise you can count on to both prevent and address the evolving risks office locations face, thanks to a detailed and bespoke underwriting process.

- Financial strength. Financial strength and stability with international reach.

- Experience & expertise. Long-term industry experience combined with deep specialist underwriting expertise.

- Superior claims service. Expert Claims teams focused on delivering superior service.

- Dedicated risk managers & consultants. Access to risk consulting from trusted experts.

- Legal sector enhancements. Enhanced Office cover for the legal industry.

Advantage spotlight

You’ll be keen to know about the following.

Travelers’ office insurance products hold a number of features that distinguish us from competitor offerings. Policyholders across the UK will have access to these unique advantages to help their office locations operate with maximum confidence.

Multinational reach

Travelers can tailor cover that addresses key exposures for companies with offices across over 150 countries. With a responsive network built up through our ‘best-of’ approach, policyholders will have access to covers determined by current and in-depth knowledge of local markets.

For further details, visit our Multinational insurance page.

Criminal Protection Response

Travelers offers Criminal Protection Response (CPR) for companies who have offices around the world, but do not have the in-house capability to handle criminal incidents that occur outside of the UK.

- Reimbursement of ransom monies resulting from express kidnap

- The loss of ransom monies in transit resulting from express kidnap

- Fees and expenses of response consultants resulting from:

- Disappearance

- Hostage crisis

- Threat (no ransom demand)

- Directors, officers and employees for all insured events

For further details, visit our Criminal Protection Response page.

First Recovery

First Recovery is a disaster recovery service that offers practical support to help get office operations back up and running quickly. Should an insured event such as fire, flood or explosion happen at an office location, policyholders will be covered for:

- Temporary business relocation − including up to 12 employees − to one of 500 recovery locations around the UK

- IT network, broadband, reception and printing facilities provided, so affected businesses can continue operating with minimal impact to staff and customers

- Reinstatement of email domain and redirection of phone calls

- An event manager who will attend the relocation and oversee service delivery on site

For further details, visit our First Recovery: Disaster Recovery Service page.

Legal sector enhancements

Enhanced cover for the legal industry

Travelers has a proud history of providing comprehensive support to legal businesses. Many firms across the UK trust us to understand their needs and help them trade with maximum confidence.

To offer them truly specialist protection, we have created a comprehensive office insurance package of property, liability and business interruption cover, which also benefits from direct access to our dedicated claims handling and risk management teams.

Standard cover includes:

- Irreplaceable and essential documents. Recognising that law firms hold more valuable documents than other office professions, we cover their reinstatement, as well as the cost of a legal indemnity policy in the event of damage to documents related to property transactions.

- Billable hours. Understanding that every minute counts in the legal profession, our business interruption cover is based on billable hours rather than the standard loss of income.

- Valuables in trust. Providing peace of mind for solicitors holding wills or other valuable items in their care.

Optional cover includes:

- Probate, trust and guardian. Emergency cover for residential buildings where a solicitor is appointed as trustee, legal guardian or executor at short notice.

- Property during conveyance. Should a solicitor be responsible for insuring a residential property during conveyancing, we offer contingency coverage to protect them.

Let’s start the right conversation

For business

Find a broker

If you’re looking for covers and have a broker, ask about Travelers products.

If you need a broker, start with the right broker directory.

Need to call us directly? Contact us.

For brokers

Ready to chat?

Let’s work together to build the right cover for your client. Your local Travelers office is the best starting place for this. You can find them listed here.

Resources

Related services

Risk services

Businesses aren’t all alike. That’s why Travelers provides superior risk management services tailored to a company’s specific needs.

Claims services

When claims happen, our best-in-class service helps to resolve them quickly and effectively, so clients can get back to business.

Insights & industry knowledge

Articles to help your ambition succeed

Workplace Safety Resources

Creating a Safety Culture in the Workplace

Advice on how to create a safety culture in the workplace.

Risk Management Resources

Business Continuity Planning

Having a thorough plan can ensure that even when things go wrong, businesses can operate without interruption.

Risk Management Resources

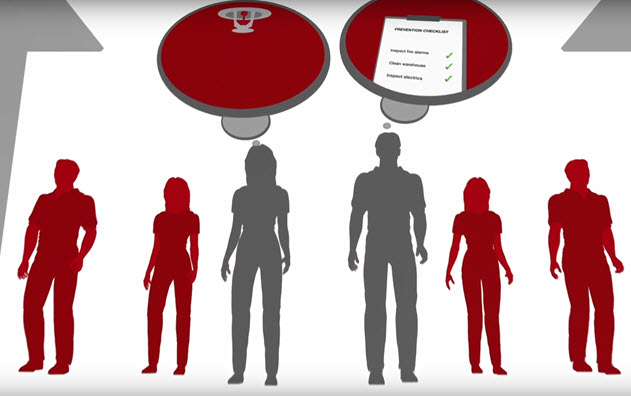

Prevent Crime, Vandalism & Arson

Advice on how to prevent crime, vandalism and arson.